The initial O’Neil Group acquisition within Braxton in 2008, offering satellite communication and C2 solutions under federally funded programs.

In 2020, the O’Neil Group Company sold its Braxton investment to Parsons for $300M. We grew Braxton over a period of twelve years with four acquisitions and millions in R&D investment. At the time of sale, Braxton Science & Technology Group (BSTG) boasted 400 employees and revenues 25 times higher than pre-investment levels. On the heels of the BSTG sale, we launched ONE Dev from a spinoff Braxton contract. ONE Dev is now the O’Neil Group’s lead defense arm applying the same growth and investment model as was used successfully with BSTG. See more at www.onedev.com.

In late 2022, we proudly acquired the esteemed Sportsman’s Cove Lodge, marking our first venture into this vibrant industry. Our commitment is to enhance the lodge’s 34-year legacy of exceptional hospitality, offering guests unparalleled charter fishing expeditions, luxurious remote lodging, and an authentic Alaskan experience. At The O’Neil Group, we’re excited to grow and innovate, ensuring that every visit to our lodge is a perfect blend of adventure, comfort, and the timeless allure of Alaska’s wilderness, all while maintaining the high standards of service and sustainability that Sportsman’s Cove Lodge has been celebrated for.

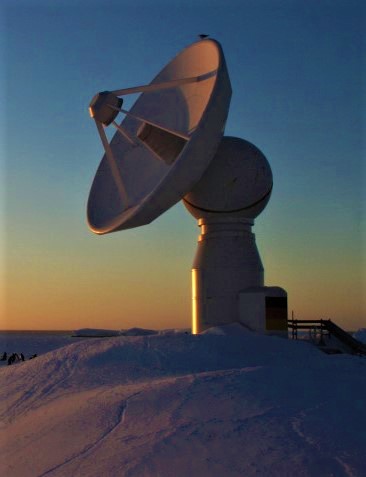

The initial O’Neil Group acquisition within Braxton in 2008, offering satellite communication and C2 solutions under federally funded programs.

Space Ground System Solutions, acquired to expand the Braxton offering and customer base.

Acquired to expand the Braxton offering and customer base.

Acquired to expand the Braxton offering to include hardware options in support of existing software-based solutions.

A minority, non-controlling investment into NDP was made to ensure an enduring strategic partnership, expanding Braxton customer solution options.

A minority, non-controlling investment into Gnostech was made to ensure an enduring strategic partnership, expanding Braxton customer solution options.

Investment into LJT made to shore up critical support to NASA and NOAA and add to the core of high-profile programs supported by Braxton.

Investment in CTRAC as a non-profit was made to support critical technology transfer initiatives.

In 2011, the O’Neil Group stood up an internal property management and brokerage company, Paramount Group, to provide high levels of support for its portfolio properties while retaining revenue and profits within the related companies.

OGC Management, established to provide construction services, performed over $25M in renovations at portfolio properties.

Space Capital Colorado, established to select and make initial investment in high potential Catalyst Accelerator participants.

Federal Consulting Contracts Division, established to perform job-specific construction support services to for portfolio properties.

Acquired to provide commercial products and services to portfolio properties and other businesses up and down the Colorado front range.

In 2012, the O’Neil Group exemplified its approach of identifying top operators in their field by investing in HCMWS, a healthcare services company. Dominick DiVello, one of the leading Colorado-based entrepreneurs and operators in his field, has led the company to revenue and market share growth in every year of the company’s operation.

Acquired to expand the HCMWS offering and customer base.

Established in partnership with experts in the DoD accounting field to support portfolio and outside businesses.

Acquired as an initial low-risk foray into the consumer products sector.

Acquired as a real estate-focused asset with a cash flowing operation to fund planned renovations.